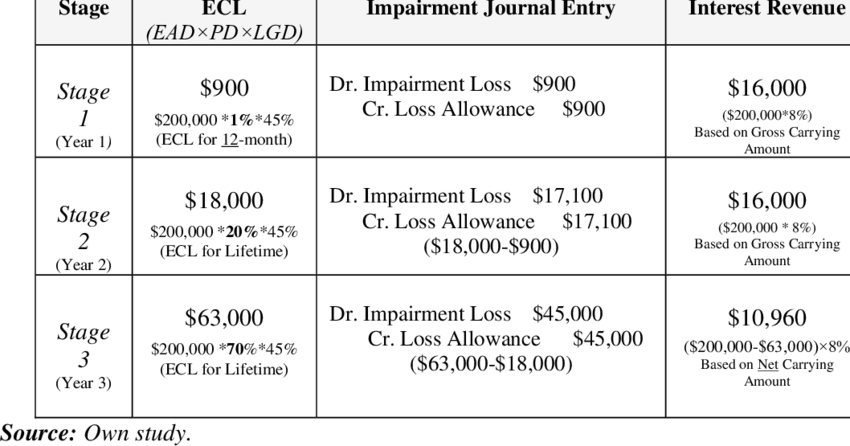

Impairment Loss Journal Entry

An impaired asset is a companys asset that has a market price less than the value listed on the companys balance sheet. Likewise in this journal entry total assets on the balance sheet decrease by 20000 and total.

Accounting For Property Plant And Equipment Reversal Of Impairment Loss Part 1 Youtube

Treatment for Appendicitis With Appendicolith by the Stone Size and Serum C-Reactive.

. Changes to the status of an individual asset do not signal impairment and frequently only the estimated service life needs adjusting. This loss generates from various sources. The journal entry is debiting impairment expense 50 million and credit machinery 50 million.

A company may need to de-recognize a fixed asset either upon sale of the asset to another party. Impairment loss assets book value assets fair value or the present value of the future cash flows expected. It addresses the accounting for financial instrumentsIt contains three main topics.

Cash comprises currency coins petty cash Petty Cash Petty cash means the small amount that is allocated for the purpose of day to day operations. The Journal of Surgical Research welcomes original research focused on minimally invasive surgery. Disposal of fixed assets is accounted for by removing cost of the asset and any related accumulated depreciation and accumulated impairment losses from balance sheet recording receipt of cash and recognizing any resulting gain or loss in income statement.

Debit your Loss on Asset Disposal account 2000 debit your Accumulated Depreciation account 8000 and credit your Computers account 10000. GAAP also requires goodwill and other identifiable intangible assets. Read more checking account Checking Account A checking account is a bank account that allows.

IFRS 9 is an International Financial Reporting Standard IFRS published by the International Accounting Standards Board IASB. The journal entry would be. We already have a balance of 20000 in the revaluation surplus account related to the same building so no impairment loss shall go to income statement.

Sometimes there is a sudden drop of the fair value of the fixed asset which leads to the impairment that the company cannot ignore. Classification and measurement of financial instruments impairment of financial assets and hedge accountingThe standard came into force on 1 January 2018. A reduction in diffusion capacity is the most commonly reported physiologic impairment in post-acute COVID-19 with significant decrement directly related to the severity of acute illness 54344.

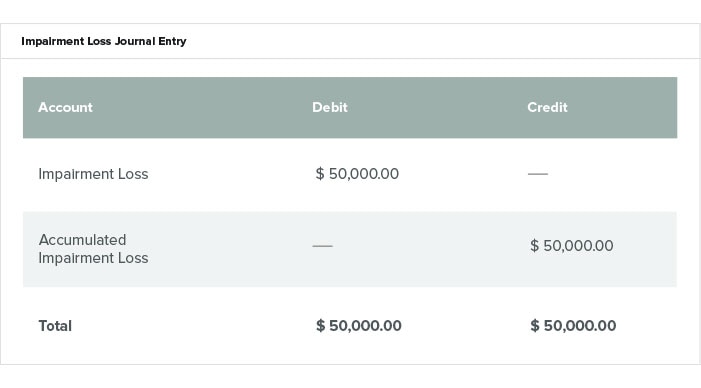

Below is an impairment journal entry when the loss is 50000. It is unreasonable to issue a check for such small expenses and for managing the same custodians are appointed by the company. Companies are advised to carry out the impairment test only when they are sure that the assets carryingbook value cannot be recovered permanently.

Acquisition cost includes all the expenditures required to make an asset ready for the intended use are included in the acquisition cost of the asset. The impairment may apply to one asset or a group of assets. Impairment Loss Asset Total.

The Journal of Adolescent Health is a multidisciplinary scientific Journal dedicated to improving the health and well-being of adolescents and young adults. The decrease in the fair value in this case is 20000 160000 140000 and as the balance of revaluation surplus is only 18000 in above example the excess amount of 2000 20000 18000 will go to the impairment loss account. Submit your MIS manuscript here.

First published in 1981 the American Journal of Kidney Diseases AJKD is the official journal of the National Kidney Foundation AJKD is recognized worldwide as a leading source of information devoted to clinical nephrology research and practice. Take a look at the following journal entry example. Impairment loss represents the difference between an assets recoverable and carrying values.

The journal entry above shows the write-off of an asset from the Balance Sheet. 100000 Accumulated impairment loss 100000. Accounts that are likely to be written down are the.

Receive the cash from the insurance company. And of course dont hesitate to. Impairment majorly constitutes a reduction in the value of an underlying asset.

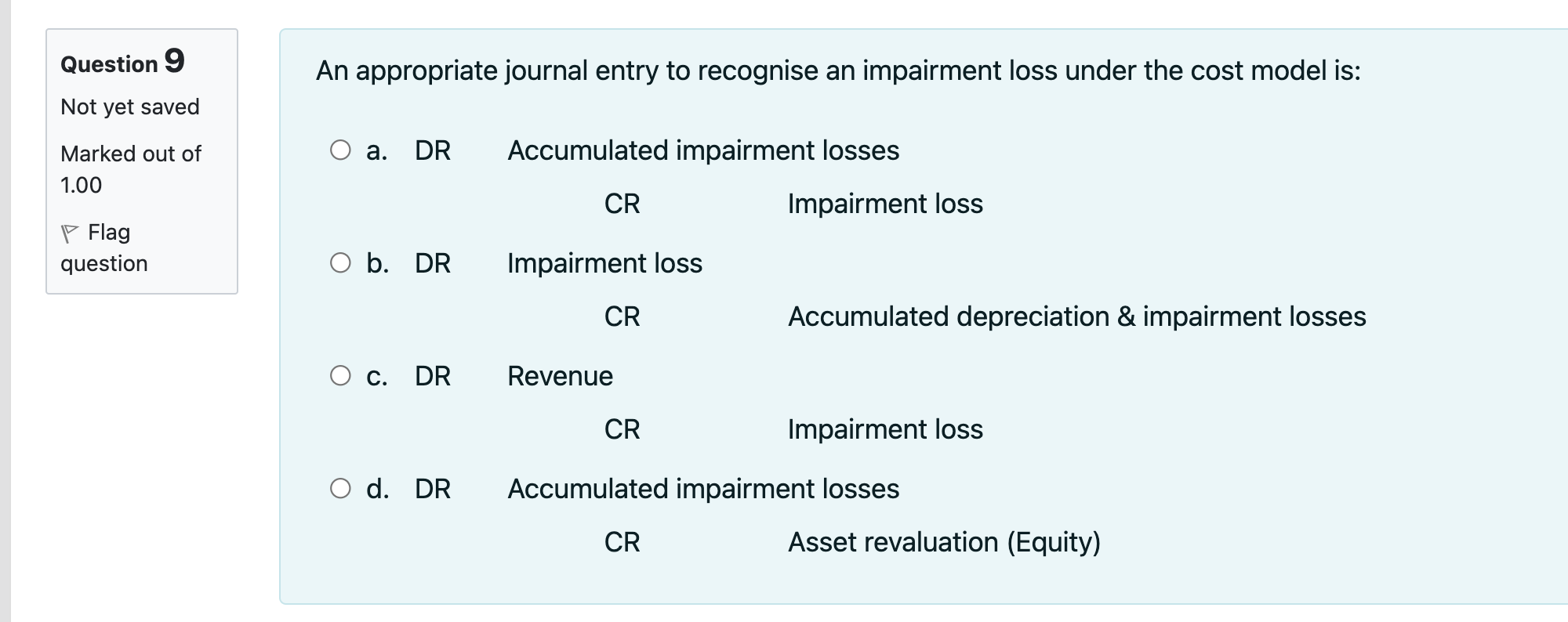

In order to record the reduction in the value of the asset the loss needs to be charged to the Income Statement as an expense. The National Kidney Foundation is the largest most comprehensive and longstanding. Accounting Treatment for Impairment.

Impairment Loss Journal Entry. Cost of demolishing an old building on land purchased is included in the. This makes your loss 2000 10000 8000.

Please record the journal entry of impairment loss. The Journal publishes new research findings in the field of Adolescent and Young Adult Health and Medicine ranging from the basic biological and behavioral sciences to public health and policy. Most Read Last 30 Days Full length article.

We have more how-tos when it comes to booking journal entries which can be found right here. So we need to reduce the balance of fixed assets machinery by 50 million and record impairment expenses. And thats how you book a fixed assets journal entry.

Then records the impairment loss journal entry as follows. Nonetheless companies must account for them in their. If the fair value of property plant and equipment is lower than the carrying amount the asset is impaired and an impairment loss is recognized.

Based on the report from a technical expert the impairment loss is 50 million. Write off the damaged inventory to the impairment of inventory account. When the claim is agreed set up an accounts receivable due from the insurance company.

Fixed asset impairment journal entry Overview. Likewise if that happens the company needs to make the fixed asset impairment journal entry in order to record the loss as a result of impairment in the income. For example if the table is damaged in some way you may need to decrease the book value of the asset and record an impairment loss on your income statement.

In each case the accounting for insurance proceeds journal entries show the debit and credit account together with a brief narrative. The carrying amount exceeds the fair value by 7648 so the account balance should be reduced by that amount. Muscle memory is a form of procedural memory that involves consolidating a specific motor task into memory through repetition which has been used synonymously with motor learningWhen a movement is repeated over time the brain creates a long-term muscle memory for that task eventually allowing it to be performed with little to no conscious effort.

Accounting Treatment For Impairment Of Financial Assets Under Ifrs 9 Download Scientific Diagram

Solved Question 9 An Appropriate Journal Entry To Recognise Chegg Com

Fixed Asset Accounting Made Simple Netsuite

Impairment Loss Accounting Impairment Of Assets Held For Use Vs Intended For Disposal Youtube

No comments for "Impairment Loss Journal Entry"

Post a Comment